With this last action, you have got attained a whole knowledge of tips discover pending deposits to your Bucks App and take the required actions associated with your pending deposits. When you faucet to your balance, you happen to be brought to a display that provide a more intricate writeup on your account harmony. That it display screen you will make suggestions the total equilibrium, readily available equilibrium, and any money that will be currently pending or under remark.

Choosing an informed On line Financial institutions One Get Dollars Places for your requirements | pop over to the web-site

Following consider the pop over to the web-site required web sites below, handpicked by our team out of pros. Even if you discover you would like an on-line financial which will take cash dumps, you’ll need to restrict the choice. Pinpointing a knowledgeable on the web financial for your requirements boils down to the new after the things. For those who’lso are already an environmentally-friendly consumer, Atmos’ Cash-Straight back Savings account can present you with to 5% cash return on your own orders. Some deals are digital today, bucks hasn’t kept our life completely. The brand new electronic globe is get off united states wanting to know what to do whenever people give us a great four-buck expenses unlike a cards.

Manage much more to your Chase Mobile app

Your website you are about to get into can be quicker secure and may also provides a confidentiality report one is different from Freeze. These products and features offered on this third-people site commonly given or secured because of the Frost. You can use all of our mobile application otherwise our web site to agenda an appointment in order to meet with our company inside an economic cardiovascular system otherwise rating a call right back because of the cellular telephone.

Put checks from your own mobile phone – help save a visit to a department or Atm. Learn regarding the getting the Virtual assistant work with repayments thanks to direct put. If you don’t currently have a lender membership, the brand new Experts Professionals Banking System (VBBP) is also hook up you which have a financial which can assist you to prepare an account. For individuals who already have one to, find aside ideas on how to improve your lead deposit information.

- Whilst you is also withdraw of a demand put membership both instantly or in a few days, label put profile are created to keep your money for a certain time.

- You’ll initiate the new percentage processes online in your ConnectNetwork account, then over your own deal which have bucks at the a great using regional store.

- Our very own Believe Finance solution enables you to deposit currency in to an enthusiastic inmate’s commissary account.

- We provide Free easy to use Custodial deposit security, and you can a well-cost Covered plan.

- Just start the exchange since you generally perform, discover Consider much more from the chief selection then Changes PIN.

- One to small breeze of your own look at isn’t all that’s needed to ensure a successful purchase.

- The fresh software uses SSL encryption tech to safeguard your own personal suggestions and you may economic purchases.

Cellular Dumps are paper checks transferred by the the person using an excellent cam or scanner without the need to check out a physical borrowing from the bank connection or lender branch area. It’s a feature on most mobile banking apps that enables one capture a picture of your own view and you can publish having but a few clicks, no matter where you are. The HFS membership, but Business Account, qualify to make use of Mobile Deposit as long as they is subscribed to Online Banking and have installed the new Mobile Application. Find Pursue.com/QuickDeposit or the Chase Mobile app to own qualified cell phones, restrictions, words, standards and you will info. Sure, cellular view deposit is actually covered by multiple levels of protection.

In order to qualify for the fresh highest APY, you must have an automated put with a minimum of $five hundred and you will seven digital distributions (such requests, Automatic teller machine withdrawals, bill money, etc.) a month. If your membership doesn’t see these types of criteria, the fresh APY is actually 0.10% regarding day. That it account boasts a competitive 5.25% APY to the all of the harmony tiers and no lowest harmony or month-to-month repair payment.

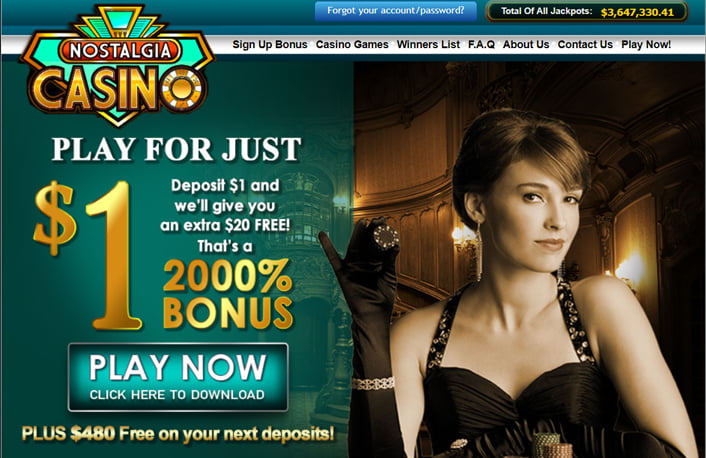

Put bonuses is a pleasant a lot more that you may possibly score just after placing down money, if you are no deposit bonuses are given for only signing up. Obviously, you will probably want to come across those individuals casinos one to particularly take on their chosen cellular phone payment method. You can do this by the ticking the appropriate field from the ‘Payment method’ area.

Atm put comes to depositing a in person at the certainly the financial’s ATMs. Your own lender could possibly get inform you whenever a check are accepted, both with the mobile app otherwise an email. Once this happens, consider composing “void” or “deposited because of the mobile” along side side of your own look at and you can keeping they up to the new put comes up on your account. Immediately after guaranteeing which you can use the newest mobile deposit solution and you can your look at drops inside mobile deposit restrictions, recommend the newest view because of the finalizing on the rear.

Show with your sportsbook when you’re permitted to explore a good pay by the cellular put so you can claim an offer. Specific deposit choices have specific regulations nearby them that do not make it incentives to be claimed. Check out the put section of the betting platform, get the method, and kind from the amount of cash you wish to put.

- Bogus look at frauds generally involve an excellent scam artist contacting the sufferer thanks to email otherwise social media send as the a potential boss, bank, otherwise curious consumer to the a market site.

- Keep these basic steps in mind and, over time, they’lso are attending getting next characteristics.

- Players may get some web based casinos hold certificates from other credible government such as the Malta Playing Power.

- You will need a great postpaid relationship, where the mobile phone supplier tend to costs you month-to-month.

- You might put bucks at any of its connected AllPoint+ ATMs.

- Extremely banking institutions do not have sort of put limits to the their ATMs.

Observe how we have been seriously interested in helping protect you, your account as well as your family away from monetary abuse. Along with, find out about the common ways scammers are employing so you can stand a stride prior to him or her. Once you see not authorized costs or faith your account is compromised e mail us instantly in order to report ripoff. Just as with a vintage put, there’s constantly a chance you to a get bounce. To guarantee the finance try transmitted truthfully, it’s wise to hang onto their inspections before deposit provides removed. This way, there is the check on turn in instance some thing goes wrong in those days.

Cellular cheque put are a mobile financial unit that enables you to help you deposit cheques for the bank account making use of your mobile device. Really hyperlinks within posts provide compensation to Slickdeals. This is exactly why we offer helpful devices to evaluate these types of offers to fulfill your own personal objectives. Make sure you ensure all terms and conditions of every borrowing from the bank credit before applying.

Mobile consider deposit are a banking software feature one enables you to remotely put a for the an examining or savings account. Your own bank’s mobile view put contract often definition the sorts of inspections you’re permitted to put. Cellular put is an easy, smoother, and safer means to fix put checks in the savings account instead of having to visit a bank branch personally.

UFB Direct charges couple normal charges, however the bank tend to charge to possess overdrafts and you can withdrawals excessively out of half dozen a month. But not, you could prevent overdraft charges by the connecting an excellent UFB Direct checking membership on the savings account because the overdraft transfers between linked account do not bring a fee. On the internet financial institutions are among the better innovations of one’s past 3 decades, providing safer use of your own account twenty four/7 and much highest interest rates than simply legacy financial institutions. The one issue one to on the internet banking companies struggle with are dealing with bucks deposits.

Whenever submission a to own cellular deposit, you’ll have to recommend it from the finalizing the term. Below your trademark, you’ll also need to create certain type of the words “to possess cellular put only,” based on what your bank otherwise credit connection requires. Financial regulations need this article and, without it, the cellular take a look at put may be rejected.

Chase Overall Examining is one of the best entryway-height membership. It typically offers new customers an indicator-right up bonus, plus it’s quite simple in order to waive the fresh $twelve monthly fee. Yet not, it’s really worth detailing so it doesn’t render of a lot beneficial has otherwise advantages and it also’s not a destination-affect checking account. SuperMoney.com is a separate, advertising-served services.

Head Deposit may take one or two payment cycles for taking impression. You can also receive one or more report checks by the post before lead deposit begins. Download and you can done a form to possess head deposit into the examining otherwise family savings by send. Essentially, i find yourself running the present day business day’s deals, and you can upgrading membership balance, by the 8 a good.yards. Such as, if you are following the abreast of a that will has cleared for the Friday, everything is going to be offered after 8 a good.m.

To understand how you can secure Citi ThankYou perks to suit your banking relationshipFootnote 1. Understand how you can secure rewards to suit your banking relationshipFootnote 1. For the back and front of the look at, a sample visualize can look in the viewfinder to line up your own take a look at so that it can be easily comprehend from the app. Peak Bank is actually managed from the Tennessee Agency out of Loan providers (TDFI) plus the Government Deposit Insurance rates Corporation (FDIC). Know about exactly what Peak Lender really does with your own advice. At any point, you could potentially decide-out of the sale of your personal suggestions by the searching for Create Maybe not Offer My Information.

By providing your cellular count you are consenting to get a good text message. “That means actually very first-date profiles was successful.” Making it well worth upgrading the financial software on the newest variation your device supporting. Deposit a check directly into your own qualified examining or checking account in just a number of taps. You need to signal the name on the back from a check—a method called promoting the fresh take a look at—just before using cellular deposit. Below your trademark, you should also produce something like “To own mobile deposit just.” Dependent on your bank’s assistance, you might be trained to include the college’s term. All of our lovers never shell out me to make sure positive reviews of the goods and services.

Rescue a trip to the bank because of the deposit inspections that have your own cellular telephone, even after instances, by bringing a picture. It’s easy, as well as probably the most easier solution to put checks. Typically, deposit checks through your bank’s mobile application are a convenient feature worth playing with. But look out for these types of benefits and drawbacks before utilizing the solution.

As the Fan Club of JULIA, we strongly recommend you joining the following program to access HD quality of JULIA's video. Try it for only $1.